/

5 Reasons to Be Bullish REV

5 Reasons to Be Bullish REV

Sep 7, 2025

There are several reasons to believe that Solana’s real economic value (REV) will continue to increase. Here’s the five biggest:

📊 Increased Compute Units (CUs) per block

Already increased from 50M to 60M, a proposal is currently live to raise it to 100M. More CUs means more transactions and priority fees per block, meaning more REV, and higher yields for revSOL holders.

📉 Reduced Issuance

After the community vote narrowly failed to approve SIMD-228, it's only a matter of time until another proposal and governance vote successfully reduces Solana's issuance. (SIMD-228 did receive more "yes" than "no" votes, but not enough to pass the quorum.)

Once issuance is reduced, REV will become a much larger share of the default Solana staking mix. The default staking APY will become much more volatile as a result, making every staker aware of the dynamic nature of REV and aligning them with the ongoing growth of Solana’s on-chain activity and REV. revTec, meanwhile will present the most capital efficient way to achieve REV exposure, removing all issuance.

🤖 More Efficient Clients

Whether it be Firedancer's revenue scheduler, or new projects like Raiku or Rakurai, there are plenty of people working hard to boost collection of MEV and block reward earnings for validators and stakers. At launch, the revTec validator will run the Firedancer "revenue" scheduler, but is open to making changes to maximize yield for revSOL holders.

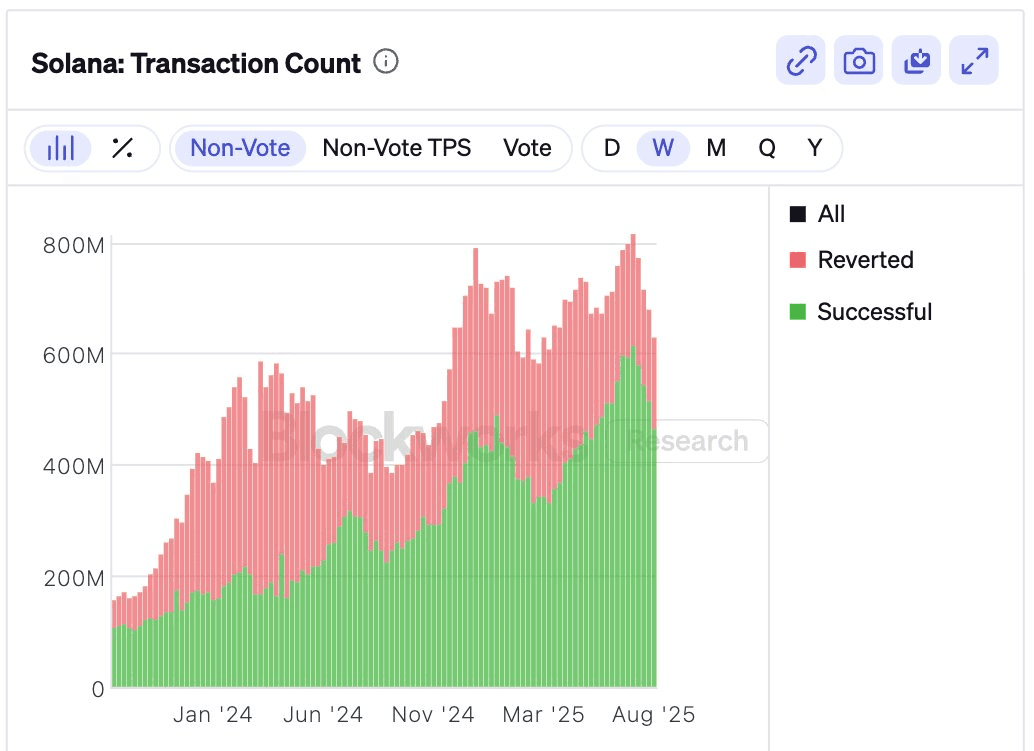

📈 Increased On-chain Activity

Although variable in the short term, it's obvious that Solana's usage is increasing over the long term. Adam_Tehc has a great thread on this.

Weekly Solana transactions. Source: x.com

🤝 Block Reward Sharing Becoming Common

The implementation of SIMD-123 on mainnet (Q4 2025 or Q1 2026?) will normalize the sharing of block rewards from validators to stakers, creating a large-scale awareness of the wealth of block rewards that can be passed to stakers. It's only a matter of time until stake pools like Marinade and Jito require this. Validators will have to reassess their fee splits to remain competitive, generally lowering their fees and increasing APYs for stakers.